Ask matric students what they would be studying after they complete school and you are bound to hear the response "Accounting" several times over. You, like so many others, may shrug at how boring this field of study sounds. Truth be told the idea of having to continuously deal with numerical facts and figures may seem like too tedious a task for the bulk of the population.

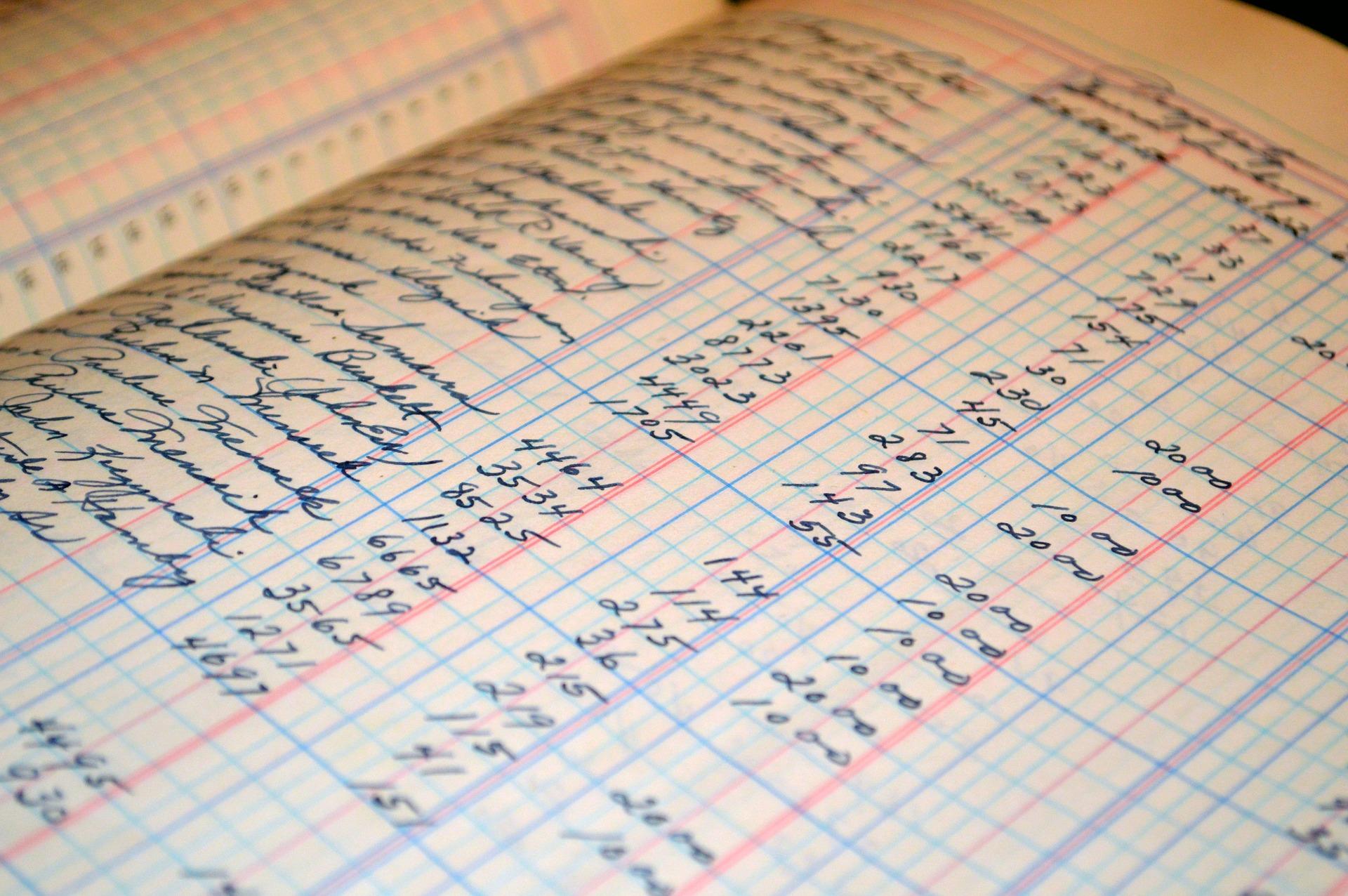

If you are the type of person who finds much delight in completing a cash receipts journal (CRJ) and you enjoy number crunching, perhaps you need to consider the field of accounting, regardless of how boring others may feel the field of accountancy may be.

You seem ready to pursue accounting but in order to decide what type of accountant you would like to be, you must know what the difference is between financial accounting and management accounting.

We are here to help you to look at both management accounting as well as financial accounting. Once we look at both fields of accounting independently, we will proceed to look at the core differences between management accounting and financial accounting.

Looking at Management Accounting

When we think of management accounting, we think of the accounting that is utilised to inform managers about operational business details. In this way, management accounting deals with all the details of products bought or services that have been paid for by the company.

To date management accountants have been confused with financial accountants. The key difference between a management accountant and a financial accountant is that a management accountant completes reports for managers within an organisation. All internal financial decisions are controlled by management accountants.

It is inevitably the management accountant who considers the financial expenses of a company as well as keeps the company's operating costs in mind as well.

Among the considerations involved in doing so, such as legal and environmental, the financial expenditures required and the impact on the company’s operating costs and even their net revenue generation is of primary importance.

You must not underestimate the value that a management accountant has for a company. They play an equally important role when it comes to estimating important facts and figures that managers need to use to project their findings to executives.

The onus then falls in the hands of executives who can approve the projections made by managers or dispute certain charges that they feel are outright outrageous.

Remember those financial statements and financial statement analyses that you would learn about during your high school accounting class, now you know the value thereof.

Find some bookkeeping courses cape town on Superprof.

When it comes to management accountants, they can work in-house or they can be contracted out to other accounting firms.

For bigger companies who have the intention of expanding, an external management accountant is usually roped in to undertake the financial decisions. Speaking of financial statements, those statements drawn up by the managerial accountant remain hidden from the eyes of the public. None of these financial statements are released to creditors or the like.

While it sounds like a management accountant has a job that is quite clear-cut, this is not always the case. Management accountants are also the persons involved in:

-

Looking after an organisation's accounts

-

Forecasting potential income and expenditure

-

Crafting future business strategies

-

Performing internal audits

-

Seeking to obtain finances and oftentimes mediating and negotiating to get the finance

-

Enforcing budget compliance within various departments

Having clarified the role of a management accountant, let's delve deeper into the daily life of a financial accountant.

If you are still keen on finding out about the exact role of a management accountant, research can be conducted or you can job shadow one for the day. Job shadowing is the best way to get to grips with the daily requirements of a specific role.

A Look at Financial Accounting

Financial accountants are involved in recording, condensing and reporting financial transactions that have taken place over a set duration of time.

You may have shrugged your shoulders and thought but that sounds no different from the role of a management accountant. While the job descriptions of both roleplayers are similar in sound, there are subtle differences in terms of what a financial accountant and management accountant do.

A financial accountant is responsible for every single company expenditure that is both internal or external to the company.

Whereas management accountants have their reporting restricted to reporting within an organisation only, financial accountants liaise and report to entities external to their organisations.

You could say that as a financial accountant you will have to report to business investors, tax authorities, and company shareholders as well.

Remember both management accountants and financial accountants hold dear the same accounting principles. The difference lies in the fact that since financial accountants report economical findings and suggestions beyond the walls of a company, they have to uphold certain standards of accounting.

A reintroduction to some of the financial statements that we completed in school is required here. The financial accountant will be sure to get his or her hands involved in compiling:

-

Asset analyses: scanning assets within the company that bring the company some value

-

Liabilities: looks at costs to the company

-

Expenditures: analyses expenses

These are but some of the financial statements and reporting that a financial accountant gets involved in on a day-to-day basis. To read more about the role of a financial accountant, read here.

Financial Accounting and Management Accounting: A Closer Look

Yes, there is a difference between finacial accounting and management accounting with the main difference being that management accountants report within a business only and financial accountants report to outside stakeholders as well.

Some of the joys associated with management accounting are that it is a slightly higher paid job than that of a financial accountant, and that management accountants have to produce periodic reports on the company's economic health, whereas financial accountants need to produce reports in set installments: annually, semi-annually, quarterly, monthly and, for some businesses, weekly.

Financial accountants tend to be restricted by the format in which they present their information so that their reports are easier for external stakeholders to grasp, management accountants are less restricted by the format with which they present their reports.

If you are feeling quite overwhelmed and the field of accountancy seems like an entirely new ballgame, perhaps consider roping in an accounting tutor to make the distinction between a management accountant and a financial accountant all the more clear.

The financial accountant remains interested in the performance of the organisation in its entirety. The financial accountant will assess the performance of the organisation this year and compare it to the performance that had been reported last year.

If this sounds like a cumbersome task, step into the shoes of a management accountant who has to forecast and predict future financial events so as to save the organisation from grave losses and by doing so making sure that the organisation will thrive in the future.

Heavy is the burden placed on the accountant's shoulders. A financial accountant will have to report all company growth as well as losses to external shareholders. That means when the company's balance sheet revenues seem to be less than that of last year, the financial accountant will have to report this loss to shareholders.

Financial accountants have to adhere to many rules and standards when drafting their reports and when actually reporting to stakeholders external to the business.

While these mentioned differences are just the tip of the iceberg in terms of the differences between the companies, there are more in-depth explanations on the differences in the roles of financial accountants and business accountants as specified by this informative article.

For those students interested in becoming accountants, knowing the differences between management accounting and financial accounting is a must.

Why?

It is management accountants who earn more, simply because these accountants tend to be given more tasks and projects to tackle.

Management accountants' progress is often reviewed and promotions are more easily given to them.

Some accountants would prefer the consistency that the financial accountant's role offers. Year after year, a financial accountant gets involved in the same type of reporting. Yet the perk of this job is that as a financial accountant you get to engage in investigating anything that seems out of the ordinary in terms of the company's finance.

You are bound to find a job easily whether you choose to be a financial accountant or a managerial accountant and it seems like it will be a long time before either role gets taken over by robotic accountants.

Find some bookkeeping courses here on Superprof.

Accounting Principles: South African GAAP

All accountants need to be aware of the generally accepted accounting principles as outlined by the Financial Reporting Standards Council (FRSP) that was formulated in 2011.

Since managerial accountants deal with future situations, they are given more flexibility in their roles and tend not to be governed by GAAP. Whereas financial accountants need to stay abreast with FRSP details as all financial reports distributed within and outside the business are governed by GAAP. These regulations ensure that all reports distributed outside of organisations are correct.

Find some online accounting courses south Africa here on Superprof.

Summarise with AI: